Discover how Defaqto Star Ratings guide better insurance choices

England & Wales: Most blocks are insured by the freeholder, but if you own the freehold (or a slice of it) the legal duty falls on you to insure your share.

Scotland: The Tenements (Scotland) Act 2004 makes every flat owner responsible for arranging adequate common-buildings insurance.

Mortgages: Lenders nearly always insist you have buildings cover before completion.

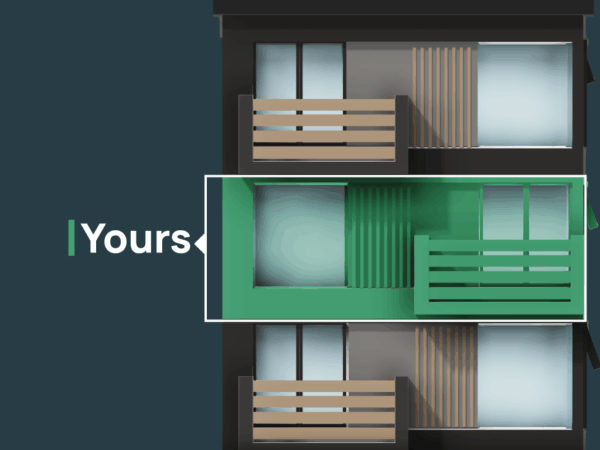

Our policy fills the “no-one else has insured the block” gap by letting you cover just your flat plus your percentage of communal areas, walls, roof, stairwell foundations and all.

Suitable for:

From load bearing walls and concrete floors to your proportion of stairwells, lift shafts and roof structure, our policy safeguards exactly the slice of the block you’re liable for.

Nothing missing, nothing duplicated.

Family Legal Protection Plus extends this cover limit to £50,000 and increases the range of legal disputes that you’re covered for.

Enjoy complete protection with extended emergency callout cover with up to £1,000 per callout, £1,000 Total Claims Limit/Year, Boiler & Heating System cover & Alternative Accommodation

Cover for accidental breakages or damage to your buildings e.g: putting your foot through the ceiling, or accidental breakage of glass

No. If a block policy exists you’d be paying twice. Our endorsement automatically cancels duplicate cover and refunds you.

Yes, add contents or personal-belongings cover during your quote and manage everything under one policy.

When we’re notified we’ll cancel your policy back to the start date and give you a full refund, so you’re never double-charged.

Check the lease, title deeds, or management-company accounts. If unclear, split the total rebuild value by floor area as a rule of thumb.

The standard £250 excess is shared across the flats involved in the claim. Higher voluntary excesses can reduce your premium.

Browse our guides and articles for all your home insurance tips and tricks.

Discover how Defaqto Star Ratings guide better insurance choices

Up for renewal? Find out how your renewal price is calculated.

Understand how having a lodger impacts your home insurance.

If you’re currently insured with us, you’ll find the documents for your policy in MyAccount.

Making a claim has never been easier – just follow these three simple steps:

Find your insurer’s claims contact details in your policy document or Schedule. Always have your policy number to hand, as it helps your insurer’s claims team quickly identify you and assist you without delay.

Call your insurer’s claims team as soon as the incident occurs. Provide a brief description of what happened and, if applicable, notify the Police within seven days for incidents like theft or malicious damage.

If required, complete and return the claim form along with supporting documents (receipts, photos, etc.) within 30 days. This ensures a smooth, timely processing of your claim.

*We may not be able to quote in all circumstances. Cover limits/restrictions and/or conditions may apply to the policy. These are clearly detailed prior to purchase, and in the policy documentation for you to determine if the cover is suitable for your needs.