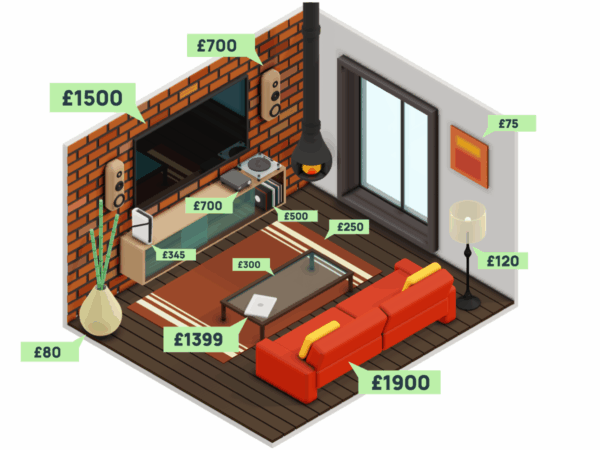

This guide explains how to work out the total value of your possessions & why accurate valuation is important.

Contents insurance protects what’s inside your home. Think furniture, tech, jewellery and clothes.

If you lost everything after a fire or flood, replacing it all would be costly. Contents cover helps you recover.

Unlike buildings insurance, there’s no legal or mortgage requirement to have contents insurance. But it’s a sensible way to protect the things that matter to you.

Intelligent Insurance offer up to £100,000 cover for your contents.

Time to complete: ~10 minutes

Many policies include a blanket limit to help guard against underinsurance. Always check your Policy Booklet and Schedule for limits and excesses.

Include cupboards, the loft and shed/garage. Don’t forget rugs, curtains and freestanding appliances.

Start with sofas, beds, TVs and white goods. Then add smaller items that add up, like clothes, books and cookware.

Jewellery, watches, laptops, cameras, musical instruments and hi-fi. Keep receipts/valuations and photos where possible.

Compare each item’s value to your policy’s single-item limit. Specify any item above the limit individually on your policy.

Home contents insurance from Intelligent Insurance provides cover for your belongings for events such as theft, malicious damage, storm, impact, subsidence, ground heave and landslip, fire, escape of water or oil.

We also provide cover for damage to food stored in a refrigerator or freezer, replacement locks and keys and occupiers and personal liability.

Cover for valuable items you specific separately on your policy.

Cover for items you take outside of the home with you, such as mobile phones

Cover for accidental breakages or damage to your buildings e.g: putting your foot through the ceiling, or accidental breakage of glass

Cover for our bicycle(s) when taken away from the home

Contents insurance pays to repair or replace the things you own if they’re stolen or damaged by insured events like fire, flood or escape of water. It’s different from buildings insurance, which covers the structure and fixtures. Most policies pay “new-for-old” up to your contents sum insured.

Typically theft, fire, escape of water, storm, flood and malicious damage. Policies may include freezer food and replacing locks and keys. Accidental damage and cover away from home are optional upgrades; limits and excesses apply.

Add up the new-for-old cost of everything you own. Include high-risk items and check the single-item limit; specify items above it. Don’t forget cupboards, the loft and any covered outbuildings.

Use our 4-step guide to calculate your contents cover amount.

It isn’t a legal requirement, but most people would struggle to replace everything after a loss. Homeowners often pair contents with buildings cover; tenants insure their own contents.

This guide explains how to work out the total value of your possessions & why accurate valuation is important.

In this article, we’ll explore why contents insurance is essential for students, what it typically covers, and how to choose the right policy for your needs

Learn all about "contents in the open" to protect your garden furniture & other outdoor items during summer season.

If you’re currently insured with us, you’ll find the documents for your policy in MyAccount.

Making a claim has never been easier – just follow these three simple steps.

Find your insurer’s claims contact details in your policy document or Schedule. Always have your policy number to hand, as it helps your insurer’s claims team quickly identify you and assist you without delay.

Call your insurer’s claims team as soon as the incident occurs. Provide a brief description of what happened and, if applicable, notify the Police within seven days for incidents like theft or malicious damage.

If required, complete and return the claim form along with supporting documents (receipts, photos, etc.) within 30 days. This ensures a smooth, timely processing of your claim.

*We may not be able to quote in all circumstances. Cover limits/restrictions and/or conditions may apply to the policy. These are clearly detailed prior to purchase, and in the policy documentation for you to determine if the cover is suitable for your needs.

We work with experienced and established insurers to give you peace of mind that your home is protected